Statistics Canada released its monthly mineral production report for May 2025 on Monday (July 21). The data shows that the production of both copper and silver increased from April. Copper output rose to 36.3 million kilograms from 35.85 million in April, and silver increased to 26,502 kilograms from 25,412. Meanwhile, gold production decreased marginally to 16,518 kilograms from 16,640 the previous month.

However, shipments were up across the board. Copper shipments rose to 34.34 million kilograms compared to 30.01 million kilograms in April. Silver increased to 26,376 kilograms, up considerably from 22,106 kilograms a month earlier. Gold shipments saw a slighter gain, rising to 14,858 kilograms from 14,660 kilograms in April.

The report comes amid heightened uncertainty due to tariff threats from the United States.

On Friday (July 25), President Donald Trump stated that the US and Canada may not reach a new trade deal, implying that there may not be further negotiations, and suggested that Canada may “just pay tariffs.”

Earlier in the month, the White House sent letters to several nations, informing them that tariffs would take effect on August 1 if no deal was reached before that time. The US threatened Canada with a 35 percent tariff on all goods not covered under the current Canada-United States-Mexico Agreement (CUSMA), which was negotiated during Trump’s first term in office.

The president’s remarks come after Canadian Trade Minister Dominic LeBlanc said that he felt encouraged following meetings earlier in the week with US representatives, including Commerce Secretary Howard Lutnick.

Markets and commodities react

In Canada, equity markets were positive this week. The S&P/TSX Composite Index (INDEXTSI:OSPTX) gained 0.29 percent to close at 27,494.35 on Friday, setting a new all-time high, while the S&P/TSX Venture Composite Index (INDEXTSI:JX) rose 0.55 percent to 801.13. The CSE Composite Index (CSE:CSECOMP) was the largest gainer, jumping 3.87 percent to 132.89.

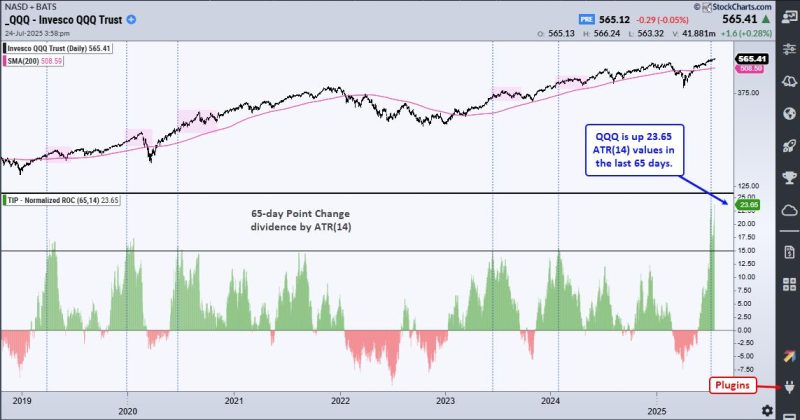

As for US equity markets, the S&P 500 (INDEXSP:INX) gained 1.18 percent to 6,388.65 and the Nasdaq 100 (INDEXNASDAQ:NDX) climbed 0.62 percent to 23,285.57, with both closing the week setting new all-time highs. The Dow Jones Industrial Average (INDEXDJX:.DJI) rose 0.74 percent to 44,901.93, closing in on its record of 45,014 set on December 4, 2024.

In precious metals, the gold price was flat, ending the week down slightly at US$3,337.31 by Friday at 4 p.m. EDT. Meanwhile, the silver price continued to trade near 11-year highs mid-week, but fell to finish the week flat at US$38.15 per ounce.

In base metals, copper posted a 3.93 percent gain, trading near all time highs at US$5.82 per pound. The S&P GSCI (INDEXSP:SPGSCI) registered a 0.75 percent loss to finish the week at 545.08

Top Canadian mining stocks this week

How did mining stocks perform against this backdrop?

Take a look at this week’s five best-performing Canadian mining stocks below.

Stock data for this article was retrieved at 4 p.m. EDT on Friday using TradingView’s stock screener. Only companies trading on the TSX, TSXV and CSE with market capitalizations greater than C$10 million are included. Mineral companies within the non-energy minerals, energy minerals, process industry and producer manufacturing sectors were considered.

1. St. Augustine Gold and Copper (TSX:SAU)

Weekly gain: 66.67 percent

Market cap: C$414.68 million

Share price: C$0.5

St. Augustine Gold and Copper is a development company focused on its King-king copper-gold project in the Philippines’ Davao de Oro province. The project consists of 184 mining claims.

According to the latest preliminary economic assessment from 2013, the company projects an after-tax net present value of US$1.78 billion, with an internal rate of return of 24 percent and a payback period of 2.4 years using a base case scenario of a copper price of US$3.00 per pound and a gold price of US$1,250 per ounce.

The company is currently working toward an update to the study.

On May 30, St. Augustine announced that it had entered into an agreement with the National Development Corporation (Nadecor) to acquire a 100 percent interest in Nadecor’s wholly owned subsidiary Kingking Milling, which holds the development rights to King-king.

Under the terms of the deal, Nadecor will receive C$9.02 million convertible into 185 million shares.

The project’s exploration and development permits are held by Kingking Mining, which remains a 40/40/20 joint venture between St. Augustine, Nadecor and Queensberry Mining and Development. The release also includes details of new ore sales and royalty agreements between Kingking Milling and Kingking Mining.

The company announced its latest news on Friday, reporting that it had closed a private placement, raising gross proceeds of C$24.9 million. In the announcement, the company said it intends to use the funds to advance development at King-king.

Additionally, the company reported on Thursday that Nicolaos Paraskevas and Andrew J. Russell had joined the board of directors. It notes that Paraskevas has experience in supervising business development activities in the copper industry, while Russell is one of the original founders of St. Augustine and brings two decades of experience in mining management. The announcement also reported that Love D. Manigsaca had been appointed as St. Augustine’s new CFO.

2. Kapa Gold (TSXV:KAPA)

Weekly gain: 62.12 percent

Market cap: C$19.66 million

Share price: C$0.30

Kapa Gold is an exploration company focused on advancing the past-producing Blackhawk gold mine in San Bernardino County, California.

The project site is composed of seven patented and 178 contiguous federal lode claims covering 1,496.2 hectares. The property hosts multiple mineralized zones with previous exploration work revealing deposits with high grade gold, silver, lead and zinc. Historic production from ramps and underground mines has graded an average 10 grams per metric ton (g/t) gold.

Kapa’s most recent news from the project was reported on March 5, when it announced it had initiated biological surveys in advance of exploration activities on the site and submitted the requested bonding to San Bernardino County, allowing for drilling on patented claims at Blackhawk.

3. North Peak Resources (TSXV:NPR)

Weekly gain: 47.3 percent

Market cap: C$47.28 million

Share price: C$1.09

North Peak Resources is an exploration company working to advance its Prospect Mountain Mine Complex in Central Nevada, US.

The property comprises 221.9 acres of patented claims and 1,905 acres of unpatented claims, consolidating several historical mines that have hosted operations dating back to the 1870s.

Despite the extensive history of the property, limited modern exploration work has been conducted, and a technical report from April 2023 notes that no mineral resource estimate has been produced. Part of the property is currently covered by a plan of operation that entitles North Peak to carry out surface exploration, infrastructural works and underground mining of up to 331,000 metric tons per year.

The most recent exploration update from the property was released on May 27, when North Peak announced results from samples collected from underground and surface historical occurrences. Highlights included grades of 45.6 g/t gold, 569 g/t silver, 4.09 percent lead and 3.12 percent zinc over 15 cm from channel samples of in-situ material from the Dean Cave area; and 5.3 g/t gold, 39 g/t silver, 7.03 percent lead and 1.92 percent zinc from dump grab samples collected from the Kit Carson mine.

The latest news from the company came on Monday, when North Peak announced it had acquired the remaining 20 percent stake in the property from Solarljos in exchange for 3 million common shares. North Peak purchased its original 80 percent interest in the property in August 2023.

4. NextSource Materials (TSX:NEXT)

Weekly gain: 46.15 percent

Market cap: C$92.46 million

Share price: C$0.475

NextSource Materials is a mining and exploration company focused on advancing its Molo graphite mine to Phase 2 production.

The mine is located in Southern Madagascar and has a nameplate capacity of 11,000 metric tons per year, with a fixed carbon content between 94 percent and 97 percent. The company is currently working towards a Phase 2 expansion at the mine, which will increase capacity to 150,000 metric tons per year. NextSource expects to complete an updated feasibility study for the project by the end of Q3 2025.

The company is also developing a series of battery anode facilities in key geographic locations. The facilities will be designed with modular production capacities that are intended to expand in line with automotive demand.

The most recent announcement from NextSource came on June 2, when it announced its withdrawal from its battery anode facility option in Mauritius, instead planning to develop a larger-scale facility in the Middle East, which would help streamline permitting and increase access to EV manufacturers. The company stated it is advancing discussions with EV manufacturers for potential offtake agreements.

5. BeMetals (TSXV:BMET)

Weekly gain: 44.44 percent

Market cap: C$10.3 million

Share price: C$0.065

Bemetals is a gold and copper explorer advancing its Pangeni copper project in Zambia.

The project is located in Northwestern Zambia along the western edge of the Central African Copperbelt. BeMetals has been actively exploring the property since 2020 and identified several areas with copper mineralization.

The most recent update from the property came on March 25 when the company reported that it had commenced a new 2,000 meter to 2,500 meter drilling program to identify additional zones of copper mineralization and expand the existing footprint within the D-Prospect area.

Previous exploration at the site has yielded highlighted assays with up to 0.74 percent copper and 533 parts per million (ppm) cobalt over 16.16 meters, including an intersection of 0.93 percent copper and 701 ppm cobalt over 5.5 meters.

On July 10, BeMetals announced that it had entered into a non-binding letter of intent with Prospector Metals (TSXV:PPP,OTCQB:PMCOF) to acquire up to a 100 percent stake in the Savant gold project in Northwestern Ontario, Canada. The property covers an area of 232 square kilometers and hosts numerous gold occurrences. Under the terms of the agreement, BeMetals has agreed to meet certain milestones, including the production of a mineral resource estimate.

Final ownership share will be determined by the size of the reported resource. If the reported resource is under 500,000 ounces of contained gold, Prospector will retain full ownership. If it is between 500,000 and 1 million ounces, Prospector and BeMetals will form a 50/50 joint venture. Lastly, if the resource is over 1 million ounces, with at least 500,000 ounces in the indicated category, BeMetals will earn the full 100 percent interest, with Prospector holding a 0.5 percent net smelter royalty.

FAQs for Canadian mining stocks

What is the difference between the TSX and TSXV?

The TSX, or Toronto Stock Exchange, is used by senior companies with larger market caps, and the TSXV, or TSX Venture Exchange, is used by smaller-cap companies. Companies listed on the TSXV can graduate to the senior exchange.

How many mining companies are listed on the TSX and TSXV?

As of February 2025, there were 1,572 companies listed on the TSXV, 905 of which were mining companies. Comparatively, the TSX was home to 1,859 companies, with 181 of those being mining companies.

Together the TSX and TSXV host around 40 percent of the world’s public mining companies.

How much does it cost to list on the TSXV?

There are a variety of different fees that companies must pay to list on the TSXV, and according to the exchange, they can vary based on the transaction’s nature and complexity. The listing fee alone will most likely cost between C$10,000 to C$70,000. Accounting and auditing fees could rack up between C$25,000 and C$100,000, while legal fees are expected to be over C$75,000 and an underwriters’ commission may hit up to 12 percent.

The exchange lists a handful of other fees and expenses companies can expect, including but not limited to security commission and transfer agency fees, investor relations costs and director and officer liability insurance.

These are all just for the initial listing, of course. There are ongoing expenses once companies are trading, such as sustaining fees and additional listing fees, plus the costs associated with filing regular reports.

How do you trade on the TSXV?

Investors can trade on the TSXV the way they would trade stocks on any exchange. This means they can use a stock broker or an individual investment account to buy and sell shares of TSXV-listed companies during the exchange’s trading hours.

Article by Dean Belder; FAQs by Lauren Kelly.

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Lauren Kelly, hold no direct investment interest in any company mentioned in this article.

This post appeared first on investingnews.com